Your Success is Our Priority

Reach Out to a Financial Expert Today

"*" indicates required fields

Kitty Medina

Nicole and Avenues Financial team was amazing to work with! They cleaned up my Quickbooks quickly and worked within my budget. They were clear about each step and have helped me understand my books better. Finally my Quickbooks are organized and I feel ready for filing Taxes for next year. I can’t thank you enough!

Kitty Medina

Nicole and Avenues Financial team was amazing to work with! They cleaned up my Quickbooks quickly and worked within my budget. They were clear about each step and have helped me understand my books better. Finally my Quickbooks are organized and I feel ready for filing Taxes for next year. I can’t thank you enough!

Kitty Medina

Nicole and Avenues Financial team was amazing to work with! They cleaned up my Quickbooks quickly and worked within my budget. They were clear about each step and have helped me understand my books better. Finally my Quickbooks are organized and I feel ready for filing Taxes for next year. I can’t thank you enough!

Kitty Medina

Nicole and Avenues Financial team was amazing to work with! They cleaned up my Quickbooks quickly and worked within my budget. They were clear about each step and have helped me understand my books better. Finally my Quickbooks are organized and I feel ready for filing Taxes for next year. I can’t thank you enough!

Kitty Medina

Nicole and Avenues Financial team was amazing to work with! They cleaned up my Quickbooks quickly and worked within my budget. They were clear about each step and have helped me understand my books better. Finally my Quickbooks are organized and I feel ready for filing Taxes for next year. I can’t thank you enough!

Welcome to Avenues Financial

We are committed to providing comprehensive financial services that allow businesses to thrive. With our expert team handling your financial needs, you can focus on growing your business with confidence.

Net Promoter Score

Our clients consistently recommend us, which is reflected in our impressive 91% Net Promoter Score.

5-Star Reviews

Our 20+ glowing reviews showcase the satisfaction and trust businesses have placed in us to manage their financial operations.

Retention Rate

We pride ourselves on our 96% retention rate, a testament to the value and satisfaction we provide to our clients.

Accounting Solutions for Businesses

At Avenues Financial, we understand that no two industries are alike, and each business requires a unique approach to their financial management. Whether you’re in agriculture, construction, healthcare, manufacturing, or any other sector, we have the knowledge and expertise to tailor our accounting services to your specific needs.

From compliance with industry-specific regulations to helping you navigate cash flow challenges, we work closely with you to develop customized financial strategies that drive growth and profitability.

Serving Businesses in Most Industries

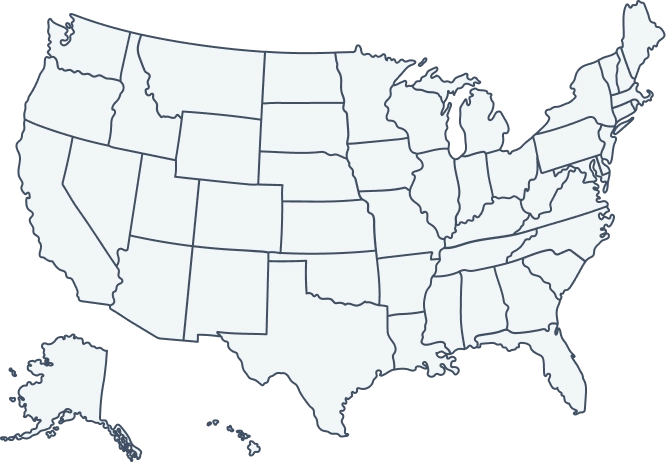

Avenues Financial proudly serves businesses across all 50 states, offering expert financial and accounting services wherever you are. Whether you’re based in a bustling city or a rural community, our nationwide reach allows us to bring top-tier accounting solutions directly to you. We understand the different economic landscapes and local regulations that can impact your business, and we tailor our approach to ensure compliance and efficiency.

From Utah to New York, and everywhere in between, our services are designed to scale with your needs, whether you’re a startup, a growing business, or an established enterprise.

Agriculture

Manufacturing

Bio-Tech

Medical & Dental

Construction

Professional Services

Content Creators

Real Estate

eCommerce

Technology

Financial Services

Avenues Financial provides bookkeeping, financial accounting, management accounting and reporting, budgeting, projections, and strategic advisory – all of which forms the foundation of your financial operations and helps you reach your goals through informed business decisions.

Bookkeeping Services

Bookkeepers are responsible for entering the data into the books and keeping the records up to date. Bookkeeping is transactional. It involves tracking all income and expenses, paying bills, invoicing, tracking payroll, etc.

Customized Bookkeeping Services

Budget-Friendly Options

Time Efficiency

Access to Accounting Experts

Accounting Software Experts

Accounting Services

Accountants provide comprehensive financial oversight, ensuring that records are accurate and financial health is maintained. Accounting goes beyond transactions by analyzing financial statements, preparing reports, tax filings, and advising on financial strategies.

Customized Accounting Solutions

Cost-Effective Services

Optimized Financial Processes

Access to Financial Experts

Proficiency in Accounting Software

Fractional CFO Services

A Fractional CFO offers executive-level financial strategy and management without the cost of a full-time CFO. They help businesses with financial planning, forecasting, budgeting, risk management, and long-term growth strategies, providing crucial insights to drive informed decisions.

Tailored Financial Leadership

Cost-Effective CFO Services

Scalable Financial Solutions

Access to Senior Financial Experts

Expertise in Financial Tools

Fractional CPA Services

A fractional CPA provides certified accounting expertise on a flexible, part-time basis. This service is ideal for businesses needing periodic assistance with tax preparation, audits, compliance, and financial reporting, ensuring that your financials remain accurate and compliant without hiring a full-time CPA.

Custom CPA Solutions

Affordable CPA Expertise

Efficient Tax and Compliance Support

Access to Certified Accounting Experts

Proficiency in Advanced Accounting Tools

Fractional Controller Services

A Fractional Controller manages your company’s accounting operations and ensures financial integrity without the need for a full-time hire. They oversee financial reporting, budgeting, internal controls, and ensure compliance, helping businesses maintain smooth operations and accurate financials.

Custom Controller Services

Cost-Effective Financial Oversight

Streamlined Financial Management

Access to Experienced Controllers

Expertise in Financial Systems

Our Clients

3 Things That Make Us Different

Most business owners don’t fully comprehend the financial issues in their business. Maybe some do, but a lot simply don’t have the knowledge to identify where they’re throwing away money or missing out on easy fixes. We understand that.

Financial Planning

When you become our client, we become focused on your success. Our team creates business growth services specially designed to deliver optimized results for your business. And as your business evolves and expands, we take the time to sit down and discuss alternatives that will make it stronger in the future.

Transparent Contracts

Our accounting packages are customizable to fit the needs and budgets of business owners and we offer up front - fixed monthly pricing for all of our services. We want all our clients to have a clear understanding of what they’re getting and what they’re paying. No one likes surprises when the invoice arrives.

Valued Relationships

Most firms are ready to bill you on time but are missing in action when you have a financial question - not us. At Avenues Financial, we truly enjoy working with our clients & have a passion for delivering great customer service. We want to understand your issues, your questions, and your hurdles to proactively find a solution that fits your needs.

Meet Our Team

Owner, CPA

Controller

Bookkeeper

Chief Marketing Officer

Bookkeeper

Bookkeeper

Controller

Bookkeeper

Proud member of the American Institute of Certified Public Accountants and the Utah Association of CPAs.

The Utah Association of CPAs

American Institute of Certified Public Accountant

Platform we have experience on

Our Locations

Our CPAs serve businesses nationwide, delivering expert financial guidance and services wherever you are. From coast to coast, Avenues Financial is committed to driving your success.

Our Awards

How to Calculate Retained Earnings

How Much Does a CPA Cost?